|

From CouttsSucks.com Of Interest

I wrote, "I feel quite meek about raising this subject, particularly when you and your colleagues have been so supportive of Marjorie and me. I am confident, however, that you will not take offence at our double-checking the quarterly interest charges we've been assessed by the Bank. We reconcile our bank and credit card statements with Quicken and find the occasional error: I believe verifying interest calculations is not dissimilar. "The interest charges for the previous quarter (March - June, 2003) just felt high to me. I tried to do the calculations myself and became hopelessly confused and bewildered. So I looked around on the internet and found ChargeChecker software from Surrey Software Services. This U.K. software is designed for the sole purpose of verifying bank interest rate charges." I downloaded daily balances from Coutts Online Banking for the previous year or so. The bank didn't have earlier figures available electronically, so Marjorie and I entered daily balances going back to March 2, 1998 into an Excel spreadsheet. I then imported the figures downloaded from Coutts and the figures keyed into Excel into ChargeChecker. I then was able to run a report showing daily statement balances and daily interest charges. I sent this report, and the ChargeChecker summary report, to Stephen. In many calendar quarters, the ChargeChecker interest calculations compared favourably with the Coutts charges. But there were many differences: the report showed a cumulative interest overcharge by Coutts of £16,752.36. I asked Stephen, "If we've made mistakes (facilities entered incorrectly, balances entered incorrectly, etc.) or if somehow the ChargeChecker software has made a computational error, I'm hopeful that you or one of your colleagues can point out the error of our ways. But if the ChargeChecker figures are at least generally correct...?" Stephen replied by e-mail the same day, "Don't be at all meek in letting me know your concerns - if we are somehow miscalculating your interest payments or acting outside the signed Advices of Borrowing Terms then I will want to correct the position."

When I was copying the ABT's I found a letter dated August 1, 2000 on the first page, and July 10, 2000 on subsequent pages. This ABT from Sasha Speed, our Coutts account officer at that time, was structured differently from previous and subsequent ABT's. It also made no mention of the interest rate to be charged on unauthorised (excess) borrowings. When this ABT was entered into ChargeChecker, the interest overcharge ballooned to £36,431.14. Further discussions with Stephen and his helpful colleague Adam Sorrin followed. In addition to our overdraft facilities, we also had a term loan at Coutts, used to finance the purchase of real estate. I e-mailed Adam on January 16, 2004, "I thought it would be prudent to use ChargeChecker to also check the interest calculations on the loan. This was complicated a bit by the fact that sometimes loan interest was charged directly to our current account, and sometimes charged to the loan itself. [...] One anomaly that I encountered occurred on August 15, 2001. For some reason our 'old' loan account was closed on that date, with the £200,000 balance transferred to a 'new' loan account. I have quickly looked through the correspondence and e-mail messages of this period, and can't find any mention of this happening, so I don't know why this was done. But I believe the transfer resulted in an undercharge of interest. According to statement page 2, we were charged £3,574.76 of interest for the period from August 15, 2001 (when the new loan account was opened) to September 2, 2001. I can't locate the interest charge for the period from, I believe, June 4, 2001 to August 14, 2001." We were apparently undercharged £1,485.04 in interest on our loan, following an unexplained transfer from one loan account to the other.

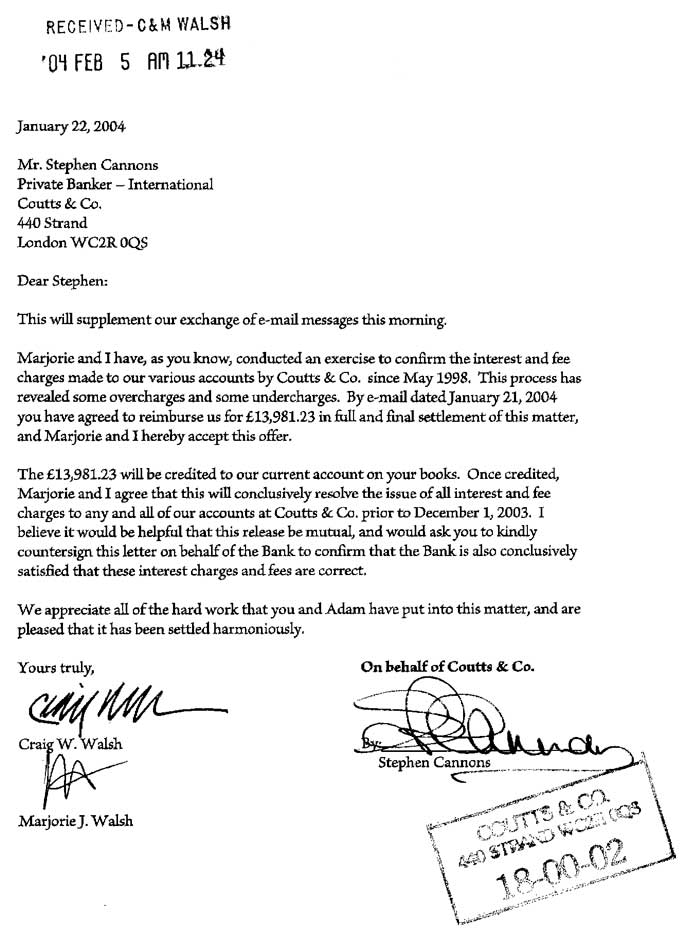

Stephen and I subsequently agreed to split this £5,000 fee --- a fee from almost four years earlier. We also agreed that we had been overcharged £17,966.27 on our current and housekeeping account (please see the summary report), and had been undercharged £1,485.04 on our loan account. The net amount due to us, therefore, was £13,981.23. By letter dated January 22, 2004 the folks at Coutts & Co. confirmed these figures, and £13,981.23 was credited to our current account on February 4, 2004.

I suspect it goes without saying, but this site is not affiliated with Coutts & Co., nor is it endorsed by them. Their website is at http://www.coutts.com © Copyright 1998-2008 by Craig W Walsh |